- Bitcoin’s graceful correction above $10,700 revived investors’ hopes of breaking the psychological level at $11,000.

- Cryptocurrency analysts foresee a downtrend despite Bitcoin having a short-term bullish picture.

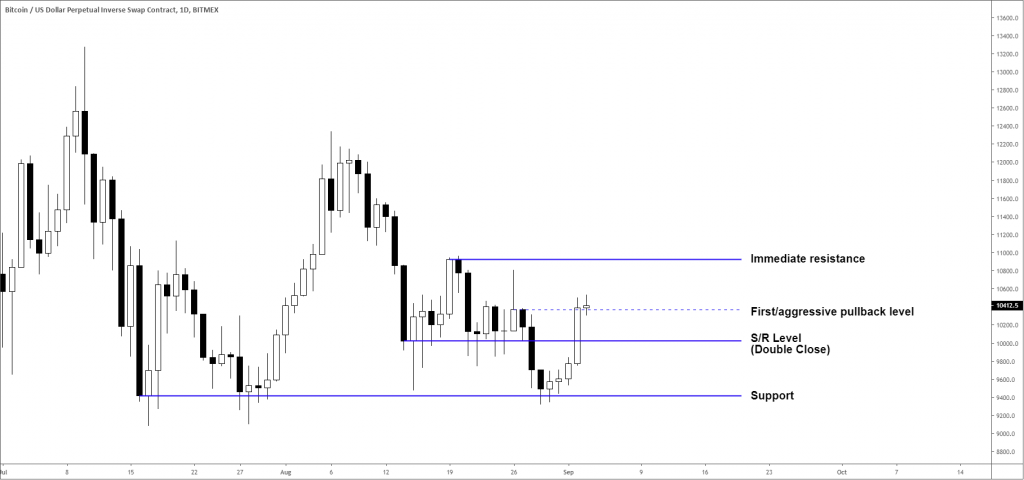

Bitcoin led the cryptocurrency market in a phenomenon recovery phase from the lows recorded in the last week of August. Bitcoin’s graceful correction above $10,700 revived investors’ hopes of seeing the oldest cryptocurrency above the psychological level at $11,000. However, BTC hit pause slightly below $10,800 and retreated to $10,500. At press time, Bitcoin price is teetering at $10,550 after a subtle 0.78% drop on the day.

Although Bitcoin’s short-term trend paints a positive picture, a number of analysts with huge followings on Twitter are advising investors to continue with caution. For example, Johnny Moe says that Bitcoin’s downside if moving. The consolidation witnessed in the last two months suggests a potential massive drop to lows around $6,000.

“Update: Still anticipating a return to the parabolic trend. Previously had ~$5,500 on this chart, assuming a quicker return to mean. Since we’ve consolidated sideways for about 2 months, the downside is more like $6,000 now.”

Another analyst, Crypto Cred outlines that the terrific move above $10,000 (broken support) did not offer any sort of resistance. He interprets the lack of resistance to be a bear trap and saying bearish continuation is very likely.

“$10,000 level that was broken support failed to provide resistance when retested. This is usually evidence of a trap (bearish continuation sellers on the S/R flip caught offside).

HTF directional bias favors upside, clearing $10,460s (intraday range high) would cement that.”

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

TRON gains 10% in 2024, supply of stablecoins reaches over $50 billion in Q1

TRON, a blockchain-based digital platform, has seen positive growth in the first quarter of 2024, as seen in a Messari report. TRON noted gains across several metrics like market capitalization, revenue and total value locked.

XRP hovers near $0.50 as Ripple CTO addresses concerns related to stablecoin launch

XRP is hovering near $0.53 on Friday, spending nearly all week below $0.55. Ripple CTO David Schwartz addressed concerns on stablecoin and XRP utility on Thursday.

Terraform Labs set to restrict access for users in the US after recent ruling in SEC lawsuit

Blockchain company Terraform Labs said Thursday that it will restrict access to some of its products and services for US-based users as it expects to receive a court order soon in light of its legal battle against the US Securities and Exchange Commission (SEC).

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s (BTC) recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?