- Bitcoin price is sitting comfortably above $6,000 as bulls look forward for the next run-up to $7,000.

- The impact of the Coronavirus continues to terrorized global economies and the digital market alike.

The Coronavirus breakout continues to wreak havoc across the globe leaving some countries such as Italy at a standstill. Financial markets including the cryptocurrency market have spent the entire week trying to recover from the damage caused by COVID-19 last week. While considerable progress has been made especially in the cryptocurrency market, the prevailing levels are significantly lower compared to the highs achieved in February.

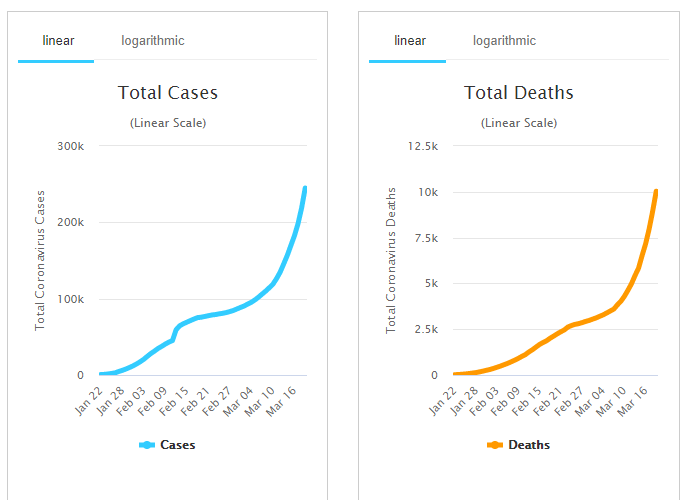

The Coronavirus worldwide update

At the time of writing, wordometer, a platform that tracts data related to the Coronavirus places the number of cases at 245,927. There have been 10,048 deaths so far, however, this number continues to increase by the hour. About 88,000 people are reported to have recovered from the virus while the number of new cases have gone down in China, the epicenter of COVID-19. However, new infections in other countries are still on the rise.

To deal with the pandemic, some countries have resorted to restricted movements while others are in total shutdown. The impact on the financial markets, cryptocurrency market and the global economy has been massive and is likely to worsen. Central banks have reacted by cutting interest rates and printing more money to ensure that demand is met during this period.

Cryptocurrency market update

BTC/USD is trading at $6,270 following a 1.4% growth on the day. Both the Asian and European sessions have been mainly bearish. However, buyers have been keen on ensuring that support at $6,000 stays in place. An intraday low at $6,063 saw the bulls pull upwards but the selling activities at $6,300 could not permit more upside action. The current trend is bearish but the low volatility hints that fast moves could be limited.

ETH/USD is in the green on Friday after adjusting upwards from $136.67 to $138 (market value). Ethereum bulls have thrown jabs at the $140 resistance but their efforts have gone unrewarded. Ethereum’s path of least resistance is downwards amid the bearish trend and low volatility levels.

XRP/USD is in the red by 1.1% after correcting lower from $0.1650 to $0.1633. A rejection at $0.1745 on Thursday allowed the bears to take over. While support at $0.16 has been strong enough to hold, XRP remains under great risk of plunging back to $0.15.

Chart of the day: BTC/USD 2-hour chart

-637202861495799334.png)

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Uniswap nears $3 billion in daily trading volume despite Wells notice and fee hike

Uniswap's (UNI) price witnessed a double-fold crash in the past week after it received a Wells notice from the SEC and later due to the general crypto market crash over the weekend. In the past week, UNI has decreased more than 38%.

Arbitrum Price Prediction: 10% losses likely for holders ahead of $107 million worth of cliff token unlocks

Token unlocks are considered bearish catalysts, particularly when recipients are likely to cash in for a quick profit. The event, which adds tokens to the project’s circulating supply without increasing demand, leaves an effective imbalance in favor of supply.

Ethereum recovers from dip as Hong Kong ETH ETF approval sparks whale buying spree

Ethereum's (ETH) price slightly improved on Monday after Hong Kong approved applications for a spot Bitcoin and Ethereum ETF. Whales have also been accumulating ETH after the market dip over the weekend.

Bitcoin price delays pre-halving rally as US and China battle for BTC supremacy ahead of halving

Bitcoin has failed to showcase an enticing pre-halving rally. As the event remains less than a week out, traders and investors remain at the edge of their seats, with thoughts on whether the impact of the fourth cycle will be different than what has been seen before.

Bitcoin: BTC’s rangebound movement leaves traders confused

Bitcoin (BTC) price has been hovering around the $70,000 psychological level for a few weeks, resulting in a rangebound movement. This development could lead to a massive liquidation on either side before a directional move is established.