- Bitcoin halving and the Coronavirus pandemic are factors that could send the price to new all-time highs.

- Devaluation of currency as a way of cushioning the economy is likely to send investors to cryptoassets.

At exactly 5.30 am AEST, Bitcoin miners arrived at block 630,000 which according to BTC code triggered a halving process. Mining rewards miners get for each block produced have now been reduced to 6.25 BTC from 12.25 BTC. The halving process takes place after an estimated four years to help the network control inflation.

The first and second halvings which took place in 2012 and 2016 respectively culminated in significant growth in Bitcoin price. After halving in 2016, Bitcoin’s parabolic rally in 2017 achieved an all-time high close to $20,000. If history is anything to go by, Bitcoin is expected to grow exponentially towards the end of 2020 and in the course of 2021. Predictions have pointed to new all-time highs above $20,000 while some go to highs of $80,000 and $100,000 respectively.

Bitcoin network has been designed in such a way that only 21 million coins will ever exist. This feature is believed to be a catalyst for another bull run as more than three-quarters of these coins are already in circulation. The CEO of deVere Group, Nigel Green said in regard to the halving:

History teaches us that after this post-halving drop in price, there is a subsequent bull run. Previous Bitcoin halving events have prompted impressive price climbs. The 2016 halving triggered a 300 percent jump in the value of Bitcoin.

There is no reason to believe this time the market will not respond with a longer-term upward trajectory.

Green predicts that Bitcoin would hit levels above $40,000 riding on the impact of the halving which will reduce the supply of new coins. He adds that the COVID-19 pandemic could also trigger another bull-run as more investors seek other forms of investments. Governments around the world are busy printing money to stimulate their economies. Excess money supply is a perfect recipe for inflation and devaluation of currency value. This could see investors seek other alternatives including decentralized assets. As green explains:

Traditional currencies are devalued and inflation fears rise on the back of the mass printing of money, the likes of which we have recently seen in the US, where the nation's central bank has added trillions of dollars to the money supply.

Besides the halving, cryptocurrencies are slowly making it to the mainstream and “are increasingly becoming regarded as the future of money due to the real-world issues they address and growing mass adoption.

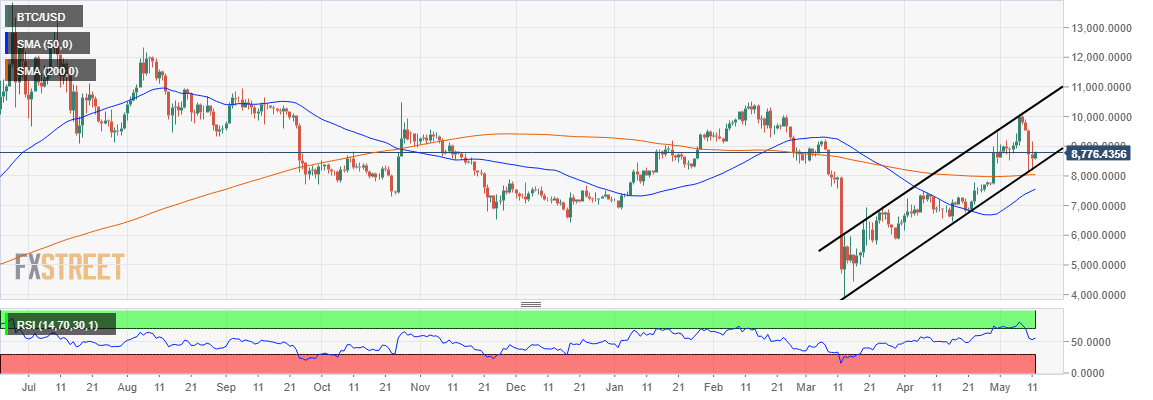

Bitcoin price update

At the time of writing, Bitcoin bulls seem to be waking up after the halving went by without a major price action. BTC/USD is trading at $8,816 after a 2.86% rise on the day. As volatility returns, Bitcoin could climb above $9,000 and even tackle the resistance at $9,200. In the medium term, all eyes are pointing to Bitcoin soaring above $10,000.

BTC/USD daily chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

MANTA suffers 4% pullback after unlocking tokens worth $40 million

Manta Network (MANTA) unlocked over 8% of its circulating supply on Thursday. The unlocked tokens were airdropped and distributed in public sale, according to data from Tokenunlocks.

XRP struggles to recover as lingering Ripple lawsuit could reach Supreme Court, former SEC litigator says

The SEC vs. Ripple potential showdown at the Supreme Court is likely, says former SEC litigator Ladan Stewart. XRP Ledger calls developers, businesses and investors to build on the blockchain, extending Apex 2024 registration until April 30.

Bitcoin Layer 2 Merlin chain TVL climbs 20%, defying broad market correction

Merlin chain’s TVL added 20% this week, and crossed $800 million on Thursday. Bitcoin Layer 2 assets noted double-digit losses in the past week. Stacks, Elastos, SatoshiVM, BVM are hit by a correction as Bitcoin hovers around $61,000.

If Bitcoin restarts bull run, these altcoins are likely to explode Premium

If Bitcoin’s consolidation ends and the bull run resumes, altcoins are likely going to trigger a massive rally. Last cycle’s hot tokens like SOL, AVAX, WIF, ONDO, etc., could see renewed enthusiasm.

Bitcoin: BTC’s rangebound movement leaves traders confused

Bitcoin (BTC) price has been hovering around the $70,000 psychological level for a few weeks, resulting in a rangebound movement. This development could lead to a massive liquidation on either side before a directional move is established.