Why Cryptocurrency Exchanges Can’t Generate Accurate Tax Reports

Are you a crypto trader who is now facing the reality of increased tax enforcement from the IRS? Perhaps you’ve taken a look at the new IRS Form 1040 Schedule 1 which will require you and every other taxpayer to declare any transactions with virtual currencies for the year 2019. The increased tax enforcement will increase tax compliance within the industry. Ignoring your bitcoin tax reporting obligations leaves you vulnerable to problems with the IRS.

How Cryptocurrency Taxes Work

For tax purposes, cryptocurrencies are classified as property, not currency. They are treated similarly to investments such as real estate and stocks for tax purposes. Any time a stock is sold for more or less than the original purchase, there will be capital gains or a capital loss that needs to be reported for that asset.

It’s the exact same for cryptocurrencies.

For example, if you purchased .01 Bitcoin for $100 and then sold it for $150, you have incurred a $50 capital gain.

The original $100 is the cost basis, the US dollars you used to purchase the asset.

The $150 is the fair market value, the amount in US dollars that you received at the time of selling the asset.

You can also incur a capital gain or loss when you trade from one cryptocurrency to another. Going back to the previous example, if you bought .01 Bitcoin for $100 and then traded it for .01 Ethereum which is valued at $1 USD at the time of the trade, you have incurred a capital loss of $99.

Every single trade or sale of a cryptocurrency is considered a taxable event, which means you need to report the cost basis, fair market value, and capital gain or loss.

The Problem with Multiple Exchanges

Although stocks and cryptocurrencies are both taxed as property, cryptocurrencies are highly transferrable in a few ways that have an important impact on tax reporting. For example, when we look at online stock trading we can see these distinct categories: assets are bought bought on an online broker, and then sold for currency, and then that currency can be used to purchase more assets. In contrast, cryptocurrencies are highly transferable in that can operate as both assets and the currencies to purchase more assets or to purchase goods and services.

Cryptocurrencies can also be transferred from online to offline locations. For example, A common scenario for many traders would be to purchase crypto from an exchange, store it for awhile in a cold wallet offline, and one day transfer it to a completely different exchange. When that crypto is transferred from the cold wallet to a new exchange there is no centralized authority recording where that crypto was originally purchased, and more importantly for tax purposes, the cost basis in US dollars.

In contrast, stock cannot be instantly transferred from one online broker to another. The process is much slower and requires documentation at every stage. Additionally, you cannot use stock to purchase goods and services. You have to sell the stock for US dollars or another fiat currency. Because of this online brokers always have access to data about the original purchase price (cost basis) and the sale price (fair market value).

Why Exchanges Can’t Generate Accurate Tax Reports

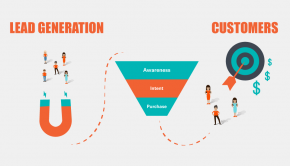

So how do you keep accurate records for your cryptocurrency transactions? The fact is that even though crypto exchanges like Coinbase retain all of your trading history, they are not able to generate accurate tax reports if you have traded on multiple exchanges. Millions of traders are constantly transferring between multiple exchanges, and this transferability is an advantage for trading, but a nightmare for tax reporting.

Let’s go back to our Bitcoin example. You purchase $100 Bitcoin on Coinbase and then transfer the Bitcoin to Binance where you trade it for Ethereum. Although there is a record of this transfer neither Coinbase nor Binance would be able to determine your capital gain or loss from that trade.

Binance doesn’t know the cost basis (because you originally purchased the asset on Coinbase) and Coinbase doesn’t know the fair market value of the trade (because the trade was completed on Binance). Any time you use multiple exchanges to trade or sell cryptocurrency, those exchanges lose the ability to provide you with accurate records of your capital gains and losses. The right hand doesn’t know what the left hand is doing, and that’s the nature of blockchain technology.

A Simple Solution

The nature of blockchain technology is also that the record for every purchase, trade, and sale of cryptocurrency is out there (which means the IRS can see it as well). It’s simply a matter of integrating this information into one place. And the good news is that bitcoin tax software does exist to automate the process of tracking cryptocurrencies across multiple exchanges. Within minutes, the tax software tool CryptoTrader.tax is able to aggregate all the years of your trading history from any exchange you’ve used onto one platform. What’s more, they provide the cost basis and fair market value in US dollars for every point of the transaction, and all your capital gains or losses can be calculated. By the end of the process CryptoTrader.tax can generate a complete and accurate tax report for all you years of trading.