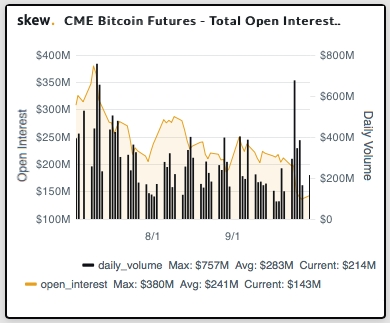

Contemplating with the price being decreased, along with that the declining OI (refer monthly open interest data which is in the negative numbers in the above nutshell provided by CME group and refer 1st exhibit for sloping OI curve), the underlying market is perceived to be making some sort of strength for the long-run.

This is because when both the participants (holder and writer) are liquidating their old positions, the Open Interest is most likely to slide.

While the JPM’s position proxies for the CME and BitMEX futures contacts are shown in the 2nd figure. Where the CME position proxy suggests the long base has declined markedly since their peak during the summer, and some further reduction this week.

By contrast, the BitMEX position proxy suggests a more marked capitulation of bitcoin longs over the past week. This position liquidation has also likely contributed to the sharp falls in bitcoin prices this week. But while the previous overhang of long bitcoin futures positions appears to have cleared in BitMEX futures, this is not yet true for CME contracts.

Finally, another recent development is that the CME has announced that it will launch options on its bitcoin futures in the first quarter of 2020. While the listing is subject to regulatory review, the contract would be a welcome development in that it expands the alternatives for investors to manage risk. Courtesy: JPM & skew.

FxWirePro- Gold Daily Outlook

FxWirePro- Gold Daily Outlook  FxWirePro- Gold Daily Outlook

FxWirePro- Gold Daily Outlook  OpenAI CEO Sam Altman's Worldcoin Unveils Human-Centric Blockchain, World Chain

OpenAI CEO Sam Altman's Worldcoin Unveils Human-Centric Blockchain, World Chain  Gaza war: Israel using AI to identify human targets raising fears that innocents are being caught in the net

Gaza war: Israel using AI to identify human targets raising fears that innocents are being caught in the net  Canada Set to Enforce OECD Crypto Tax Standards by 2026

Canada Set to Enforce OECD Crypto Tax Standards by 2026  South Korean Won Surpasses US Dollar in Crypto Trading Volume for Q1 2024

South Korean Won Surpasses US Dollar in Crypto Trading Volume for Q1 2024  FxWirePro- BGBUSD (Chart of the day)

FxWirePro- BGBUSD (Chart of the day)  FxWirePro- Gold Dailty Outlook

FxWirePro- Gold Dailty Outlook  Fiji Central Bank Cautions on Crypto Use, Dashing Bitcoin Integration Hopes

Fiji Central Bank Cautions on Crypto Use, Dashing Bitcoin Integration Hopes  Shiba Inu Burn Rate Soars 64,201%, Fueling Epic 657 Million Token Vanish

Shiba Inu Burn Rate Soars 64,201%, Fueling Epic 657 Million Token Vanish  The yen plunges to 34-year low despite interest rate hike

The yen plunges to 34-year low despite interest rate hike  In a time of information overload, enigmatic philosopher Byung-Chul Han seeks the re-enchantment of the world

In a time of information overload, enigmatic philosopher Byung-Chul Han seeks the re-enchantment of the world