The timing could hardly have been better. Or worse. In the very week that the fossil fuel industry will likely embrace a new push for a subsidy it insists is needed to keep the lights on, it demonstrates in the most brazen manner possible that it really couldn’t give a stuff whether the lights are kept on or not.

The extraordinary scenes of brinkmanship witnessed on Monday and Tuesday – and likely to continue this week in Queensland and other states – have been triggered by an automatic price cap that is designed to protect consumers from surging wholesale prices, and to cool the market.

It was implemented because wholesale prices had surged out of control – due to a heady mix of international and local factors. But far from being protected, the consumers are now being held to ransom by a group of big companies arguing that they are being “economically rational” by withdrawing their service.

Multiple gigawatts of capacity were abruptly withdrawn from the market, forcing AEMO to warn of potential widespread forced outages if it was unable to cajole them back on line. The dose was repeated on Tuesday, in both Queensland – at one stage 2GW short – and NSW, at one stage 1.7GW short.

In the end, the lights did not go out in Queensland on Monday, but it was a close run thing. Consumers were urged by the energy minister to dial down their power consumption. Energy executives report coal supplies and hydro stock at very low levels. Another unexpected failure of a coal generator, or a trip of a gas generator – neither event uncommon – could have had dramatic consequences.

And yet this is and was not about a shortage of supply, AEMO says. It is a game of brinksmanship. There is, and was, ample capacity to be switched on. It is just impossible to find a gas power plant owner prepared to do so under the terms of the $300/MWh price cap.

We’ll go into the details of how this has been allowed to happen shortly. Mostly, however, this is yet more confirmation, if any was needed, that Australia’s electricity market – designed as it was by and for the fossil fuel industry – is irreparably broken.

What happened on Monday, and again on Tuesday, suggests that many energy utilities have completely lost the plot. They have lost all perspective on what it is they are supposed to be doing. As one senior director told RenewEconomy: They are throwing away their social licence.

It might be amusing to see half a football team walking off the pitch in the middle of the game after being told their match payments had been capped.

But there is nothing discretionary about the provision of an essential service. Electricity is essential to keeping people warm at home, in work, alive in hospitals, and to enjoy a modern lifestyle.

The Energy Security Board is expected this week to put out its latest version of a capacity mechanism, and it will be enthusiastically supported by the fossil fuel industry. The need for it is heavily contested, and even if approved it would be putting little more than an expensive bandaid on a broken market.

But who is going to believe the fossil fuel industry when it says it has consumer interests front of mind after this disaster? That the capacity market is needed because they will be forced out of the market. Having watched the generators take themselves out of the market in the search for more money, not many.

So let’s just re-cap what’s going on.

Australia has been suffering – like many other parts of the world – from the impact of geopolitical events that have caused the international price of coal and gas to go into the stratosphere.

The situation is made worse by the fragility of the country’s ageing and increasingly unreliable coal generators. In the most coal dependent states, like NSW and Queensland, more than one-quarter of capacity is sidelined by breakdowns, repairs and the inability to access enough coal.

The cost of gas generation has soared at times to more than $500/MWh – not because of a shortage of gas, but because the gas industry has prioritised selling vast amounts to overseas clients.

Even after a separate cap was imposed on the gas supply market, the cost of burning gas for power is still around $400/MWh. Some coal generators, forced to buy supplies on the spot market, are paying up to $600/tonne, which requires a wholesale electricity price of more than $300/MWh just to break even.

Prices have been so high that they have triggered the automatic price cap – reached when the cumulative total of 2016 trading intervals (one whole week) reaches $1.359 million, or an average of about $675/MWh. The price cap sets a limit of $300/MWh.

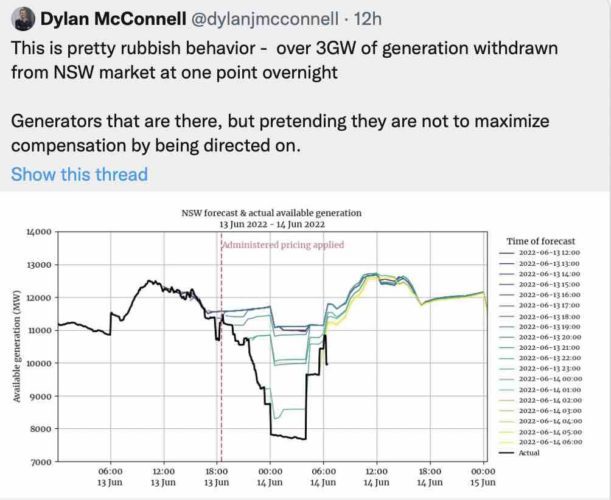

In response to this, in Queensland – where the price cap was triggered first – the move was met by a sudden withdrawal of around 2GW of fossil fuel capacity. They did it again on Tuesday, and NSW also withdrew more than 3GW when their price cap was imposed.

The owners of gas and diesel generators decided that they couldn’t get enough money under the price cap to cover their costs, so they withdrew their capacity, putting supply at risk.

But here’s the thing: The rules of the price cap actually do allow generators to get compensated for the difference between the payment and the cost of fuel.

But this is administratively complex, and the generators decided – en masse – that it was easier to effectively hold the market to ransom, where there is a clearer mechanism to get paid 90% of their average recent price when directed to switch on by the market operator.

To withdraw capacity, to force AEMO to invoke the emergency reserve trader mechanism, for governments to ask consumers to dial down consumption, and to wait for the last minute to direct plants on line, is a significant act of brinkmanship.

In the end, the lights were kept on in Queensland on Monday, although the networks and the state energy minister had to plead with consumers to dial down their energy needs. So it must have been a close run thing.

The utilities themselves might want to stop and ask themselves: What does the consumer make of this? It really is not a good look for the industry.

Those customers are now entitled to question anything the fossil fuel industry says from here on in about having consumer interests at heart. Energy consumers have felt ripped off by one part of the market for a decade or more, for one reason or another.

More than that, what trust can we now place in the industry with its promises of reducing emissions, and assisting the green energy transition. If they can’t be trusted on such a fundamental issue as the provision of supply, what are their promises worth on the issue of climate change?

Even the regulator had to take on the role of school principal. “The AER expects market participants to undertake their operations so as to ensure they are not causing or significantly contributing to the circumstances of a market direction to be issued.”

It’s pretty clear to everyone in the market that they already have, but that only highlights that the fossil fuel industry is not the only party to blame in all this.

This is also on the policy makers, the regulators and the rule makers who have allowed this farce to evolve. It has been clear for years that the market has been broken, but little has been done to fix that.

The pricing regulators have been pathetic, constantly turning a blind eye to obvious rorts, and the other authorities have also been too slow to move.

Why, for instance, is the $300/MWh price cap still in place when it is clear little fossil fuel can be produced below this cost?

RenewEconomy understands that state and federal governments are now scrambling for legal advice to resolve this issue, to see if some emergency measure can be put through, such as raising the price cap, as the market does not have time for a rule change, that would take years.

But what would the new price cap be? And what would be the impact on smaller generators that would be exposed to even higher prices.

See also: Regulator reminds generators of market obligations as Bowen plays down risk of outages