- Tunisia performs a test transfer with its new digital currency.

- Ethereum takes advantage of a weak Bitcoin and can knock it out.

- XRP is failing to react to positive news that comes from Ripple Ltd.

The Governor of the Central Bank of Tunisia has carried out a pilot transfer of CDBC or e-Dinar. Russian ICO startup Universe has provided technical assistance to the pilot test

The race towards the tokenization of sovereign currencies has begun a long time ago, but it finally enjoying its time in the sun. China has announced its intention to create an e-Yuan, and also in Europe, institutions are considering the matter.

The case of the US is different – and for now – its central bank is observing from the sidelines. It seems that, once again, it will be the private sector that will lead the technological revolution in the world's largest economy.

Crypto market weakness.

Last Friday the bearish forces were conjured up and managed to beat the $9,000 support level in the BTC/USD pair. The weekend interval had a balsamic effect, but Monday has brought with it a reactivation of the bearish momentum in the leading crypto actives.

The current winner is the Ethereum, which manages to stay above the critical level of $180. Besides, it accumulates gains against Bitcoin of more than 7% in the past week.

The technical indicators of volatility are still far from extreme levels, but the emotional tension of the market players is noticeable in every corner of this cryptoverse.

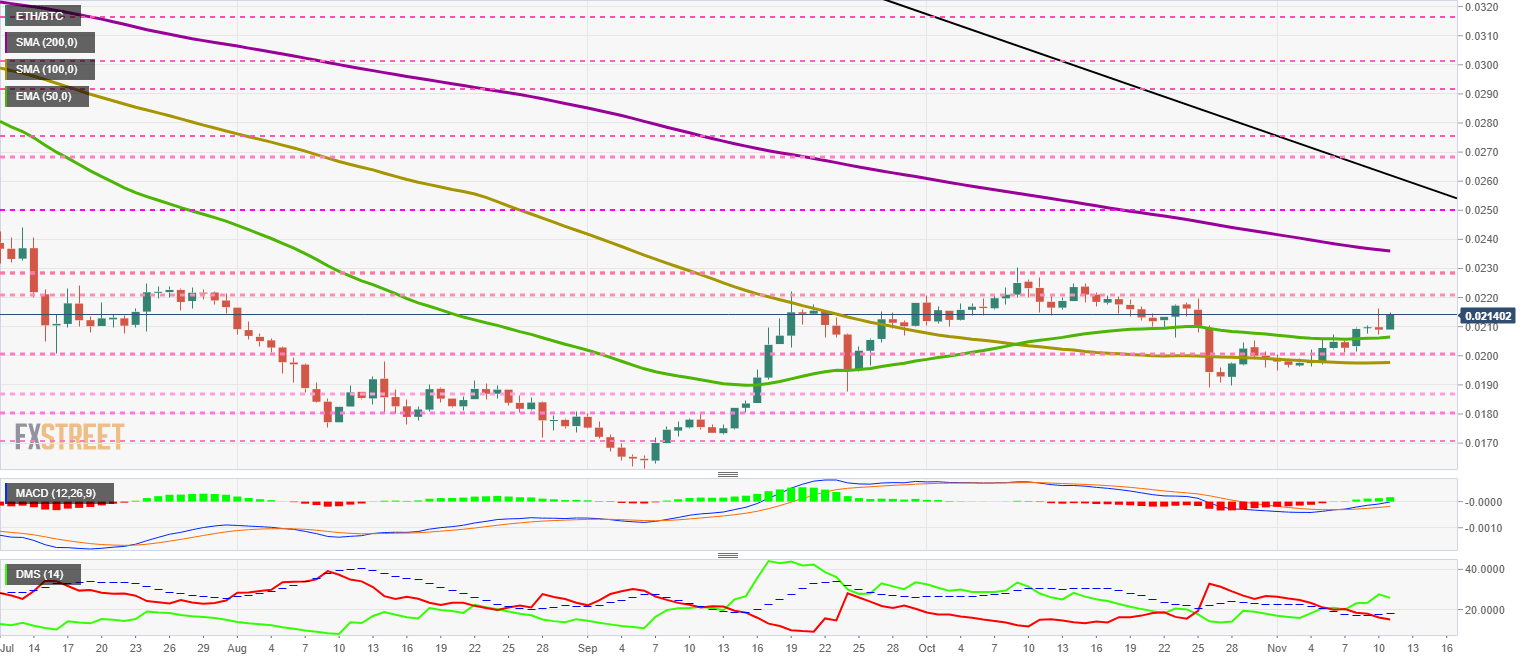

ETH/BTC Daily Chart

The ETH/BTC pair is currently trading at the price level of 0.0212 and continues the bullish trend that began in early September.

The relative gain in value comes from the side of Bitcoin's more significant weakness against Ethereum, but for active traders, the performance at stake is essential.

Above the current price, the first resistance level is at 0.022, then the second at 0.023 and the third one at 0.0236.

Below the current price, the first support level is at 0.0206, then the second at 0.020 and the third one at 0.019.

The MACD on the daily chart increases the positive slope and also the opening between the lines. Soon the indicator will reach the zero level, and we will be able to evaluate the real strength of the Ethereum against Bitcoin correctly.

The DMI on the daily chart shows how the bears lose the ADX line and confirm that the ETH/BTC pair has a massive bullish trend ahead.

BTC/USD Daily Chart

The BTC/USD pair is currently trading at the $8.692 price level and is marking a new relative low in the short term. The current scenario remains active above the $7,500 price level as support, and at $9,650 as resistance.

Above the current price, the first resistance level is at $8,800, then the second at $9,150 and the third one at $9,650.

Below the current price, the first support level is at $8,400, then the second at $8,200 and the third one at $8,000.

The MACD slightly increases the bearish profile but with limited bearish potential. The close presence of support at the zero lines and the slight slope indicate a high probability of bullish turn in the short term.

The DMI on the daily chart shows how the two sides of the market are on a collision trajectory. The result is uncertain, although the statistics are on the bear's side.

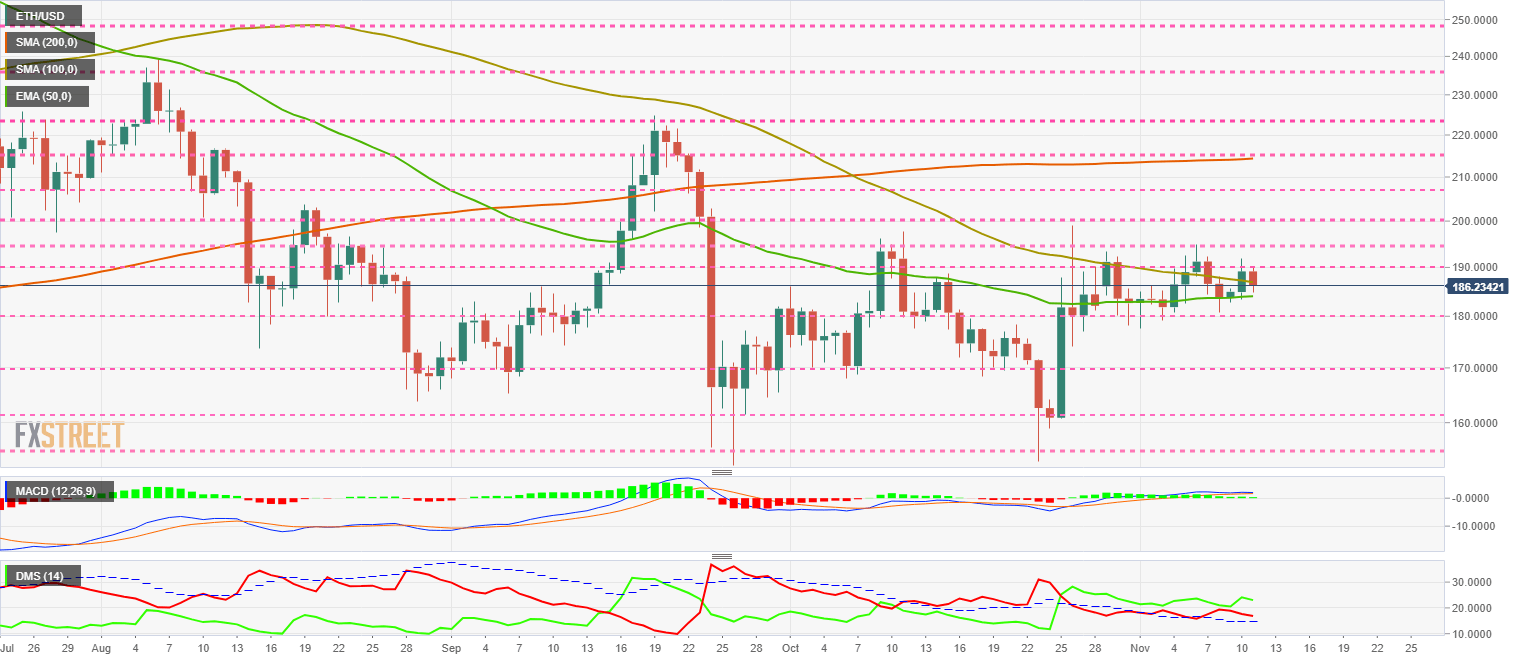

ETH/USD Daily Chart

The ETH/USD is currently trading at the $186.23 price level, narrowly losing the SMA100 but still retaining the support of the EMA50. The weakness of Bitcoin and XRP can quickly spread.

Above the current price, the first resistance level is at $187, then the second at $190 and the third one at $195.

Below the current price, the first support level is at $180, then the second at $170 and the third one at $160.

The MACD on the daily chart shows a total loss of the bullish momentum, but it does cross downwards. The indicator moves above the zero line, and it is difficult for it to drill down if it does not increase the bearish profile.

The DMI on the daily chart shows the bulls dominating the ETH/USD pair, although the bears keep the chances of fighting for leadership alive.

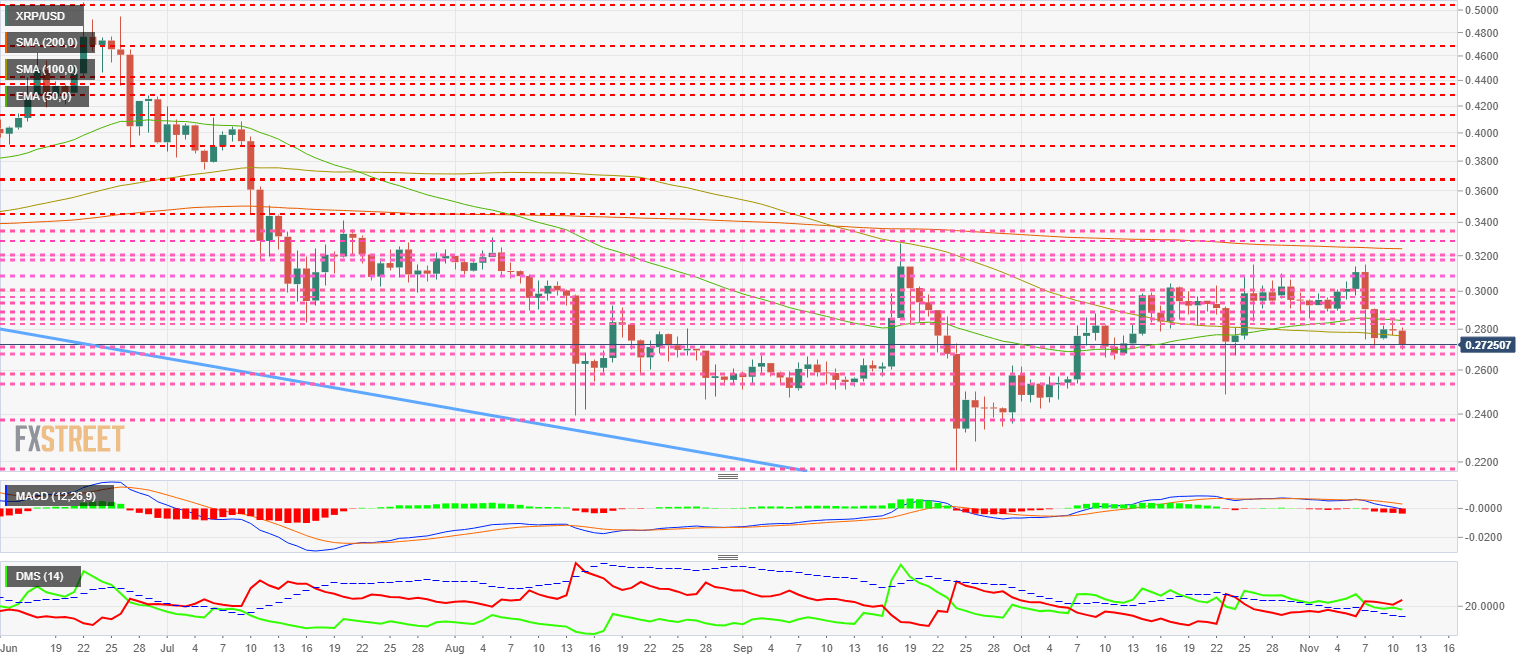

XRP/USD Daily Chart

The XRP/USD is currently trading at the $0.272 price level and is deepening at the bearish momentum of the Ripple Ltd token.

The continuous news in favour of the parent company's business seems to affect the XRP quotes negatively.

Above the current price, the first resistance level is at $0.28, then the second at $0.285 and the third one at $0.289.

Below the current price, the first support level is at $0.27, then the second at $0.268 and the third one at $0.26.

The MACD on the daily chart increases the bearish profile and attacks the supporting zero level in the session. Losing this level would add pessimism to the current situation.

The DMI on the daily chart shows a bear rally leading to the XRP/USD pair. The bulls try to maintain the right level, but the closeness of the ADX line can make it difficult for them.

Get 24/7 Crypto updates in our social media channels: Give us a follow at @FXSCrypto and our FXStreet Crypto Trading Telegram channel

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Ethereum continues hinting at rally following reduced long liquidations

Ethereum has continued showing signs of a potential rally on Tuesday as most coins in the crypto market are also posting gains. This comes amid speculation of a potential decline following FTX ETH sales and normalizing ETH risk reversals.

HBAR price jumps 75% as BlackRock tokenizes Money Market Fund on Hedera

Archax, Ownera and The HBAR Foundation have enabled the first tokenization of BlackRock’s money market fund (MMF) on Hedera. Last year Hedera Council member abrdn’s successfully tokenized its MMFs on Hedera.

Bitcoin price holds above $66K as Morgan Stanley files prospectus to add BTC ETF exposure in two of its funds

Bitcoin (BTC) price remains range-bound, holding above the $63,000 level, while its upside is capped below $68,000, going against or delaying the assumption that the fourth halving would be a 'sell-the-news' outcome.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce reliance on the US dollar after plans for a stablecoin effort surfaced online on Tuesday. Most people expect the stablecoin to be backed by gold, considering BRICS nations have been accumulating large holdings of the commodity.

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?