Here is what you need to know on Tuesday, May 26, 2020

Markets:

The digital asset market is lethargic in its trading on Tuesday. The Asian session was not eventful at all as stability seems to be dominating. The market is painted in both red and green but percentage declines or gains on the day are minor.

BTC/USD, for instance, has not been able to break the resistance at $9,000 in spite of the recovery from the weekend lows at $8,600. The largest digital asset in the industry is flirting with $8,900 but also facing a strong bearish trend. The high volatility is also jeopardizing gains eyeing $9,000. It seems that Bitcoin will take long before taking down the key hurdle. It might even require to breakout down a bit to create fresh demand around $8,600 or $8,400 before attempting to reach towards $10,000.

Read more: Bitcoin Price Analysis: BTC/USD struggle to secure $9,000 support continues

ETH/USD is dancing at $203 after adjusting from the opening value of $204.07. On the upside, $204.95 (intraday high) marked the end of the bullish momentum. Like Bitcoin, Ether is dealing with increased selling activity. Support at $202 and $200 has to hold to ensure that losses back to $190 are averted.

XRP/USD is among the leading cryptoassets in declines on the day. It has lost almost 1% ahead of the European session. Ripple is trading at $0.1944 amid high trading volume and a building bearish trend. The European session is expected to remain bearish unless a catalyst comes into play.

A glance at the top 100 cryptocurrencies, some of the best-performing tokens in the last 24 hours include NEM (up 8.05%), VeChain (up 13.01%), OmiseGo (up 14.18%), Hedera Hashgraph (up 15.33%), Enjin Coin (up 16.59%) Zilliqa (up 15.58%), and IOST (up 13.79%).

Chart of the day: BTC/USD hourly

Market:

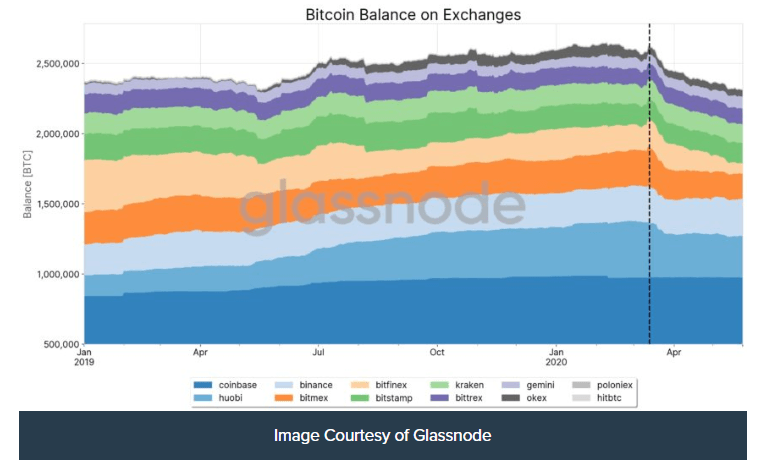

Bitcoin balances on cryptocurrencies exchanges have continued to tumble since the “Black Thursday” crash in March. Data has revealed that more than 310,000 BTC has left the exchanges’ accounts since March 12. There is a high chance that the coins have been transferred to cold storage facilities. In other words, investors are likely planning to hold over an extended period of time. The exodus of Bitcoin is by far the longest outflow according to Glassnode, an on-china data research platform.

Bitcoin has seen its largest prolonged withdrawal of funds from exchanges. According to our data, over 310,000 BTC has moved out of exchanges since Black Thursday. Largest outflows: Bitfinex: -126,845 BTC Huobi: -95,496 BTC BitMEX: -95,438 BTC.

Industry:

According to Charles Hoskinson, the co-founder of Ethereum and founder of Cardano, cryptocurrencies have a role to play in this pandemic; COVID-19 by challenging the prevailing financial systems. In his opinion, the US government could easily be suffocating small and medium-sized businesses by their current approach of padding up Wall Street and the Wealthy. The working-class citizens and the less fortunate are likely to face the harsh conditions of navigating a looming economic recession. In a recent interview, Hoskinson stated:

What’s really strange though, is there’s this counter cyclic push where the stock market is gaining value. And the principal reason for that is because central banks are just mass printing money and dumping it into the economy.

Regulation:

The Governor of the People’s Bank of China (PBOC), Yi Gang said on Monday that the central bank has no exact date laid out for the launch of the digital currency that is currently in trial across four Chinese cities. China embarked on the research and development of the digital currency more than five years ago. The aim of the digital currency is to replace some of the paper money in circulation while digitizing the economy.

Quote of the day:

“The existence of an asset [like Bitcoin] gives you the dimension of freedom that you need to start monetary innovation and start exploring and creating stablecoins and all kinds of financial products which could become dollar replacements.” (@Charles Hoskinson)

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

TRON gains 10% in 2024, supply of stablecoins reaches over $50 billion in Q1

TRON, a blockchain-based digital platform, has seen positive growth in the first quarter of 2024, as seen in a Messari report. TRON noted gains across several metrics like market capitalization, revenue and total value locked.

XRP hovers near $0.50 as Ripple CTO addresses concerns related to stablecoin launch

XRP is hovering near $0.53 on Friday, spending nearly all week below $0.55. Ripple CTO David Schwartz addressed concerns on stablecoin and XRP utility on Thursday.

Terraform Labs set to restrict access for users in the US after recent ruling in SEC lawsuit

Blockchain company Terraform Labs said Thursday that it will restrict access to some of its products and services for US-based users as it expects to receive a court order soon in light of its legal battle against the US Securities and Exchange Commission (SEC).

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s (BTC) recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Bitcoin: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s (BTC) recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

-637260710426361097.png)