According to multiple metrics, the number of deposits to major cryptocurrency exchanges has fallen drastically. Bitfinex, for example, is at a two-year low in deposits to its exchange.

Enthusiasm is high going into 2020 for the cryptocurrency space, but it seems that retail investors aren’t buying nor are even that interested.

Deposits to Exchanges Plummet

According to Token Analyst, the number of deposits to cryptocurrency exchanges peaked in 2017. Since then, there has been a decline which has, in some cases, even accelerated this year. Binance, for example, has seen deposits drop to early 2018 levels; Bitfinex is seeing its lowest numbers in two years. As Sid Shekhar, co-founder of London-based TokenAnalyst, told Bloomberg, “if we go by the ‘Bitcoin as safe haven in times of recession’ narrative, the number of new users/buyers should actually be increasing.” Yet, it’s not—and that should worry us in the short-term.

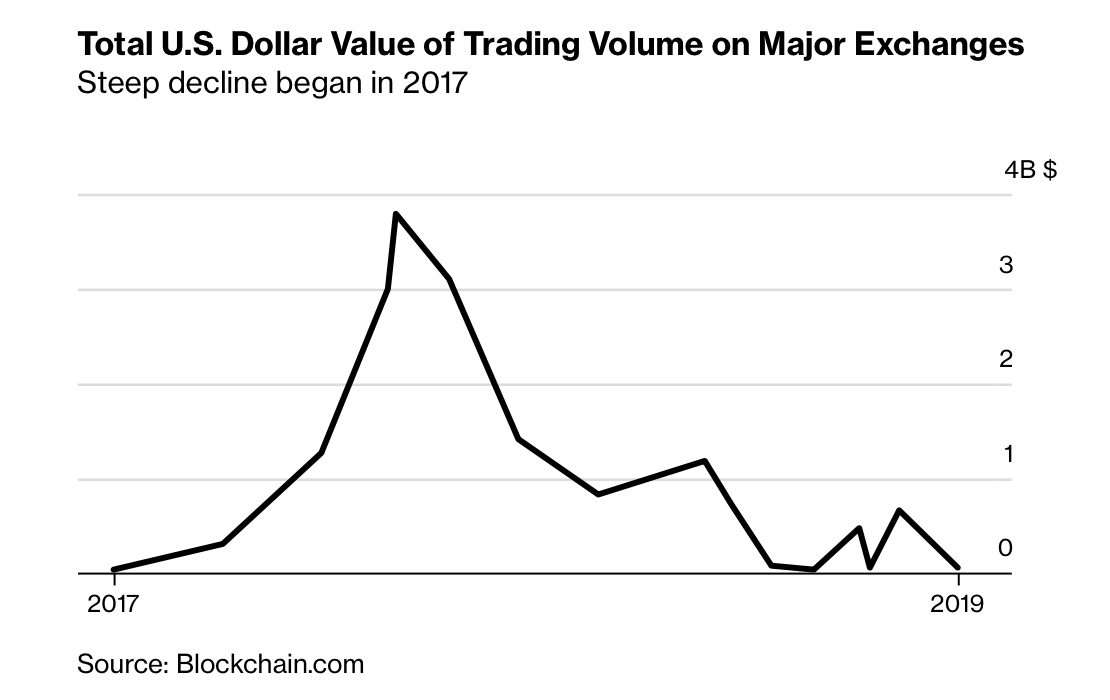

Trading Volume in USD Has Collapsed

Although it may not feel like it looking at CoinMarketCap, real trading volume in USD has plummeted. According to Blockchain.com, the trading volume for Bitcoin in USD is at its lowest point since May of this year and has been trending downward spectacularly since 2017. However, this can also be a consequence of Tether’s recent explosion in trading volume. The stablecoin now consistently boasts more daily trading volume than Bitcoin.

Alongside USD volume sliding downward, web traffic has also declined for most major exchanges. Binance, for example, is seeing its traffic drop to a four-month low. Bitfinex gives a similar story.

Related: Looking to buy and sell Bitcoin? Check out our guide on the Best cryptocurrency exchanges for trading Bitcoins.

Overall, the metrics for the cryptocurrency market don’t seem too encouraging. However, one can just as well argue that retail interest always lags behind and is generally the last part of a general bull cycle. So, we can’t predict the future based on these depressed numbers. Yet, the steep decline in retail traders across the board is an indicator that we may not be ready to break any all-time highs anytime soon.

Do you believe these metrics indicate that the market still has not recovered from the 2018 bear market? Let us know your thoughts below in the comments.

However, this can also be a consequence of Tether’s recent explosion in trading volume. The stablecoin now consistently boasts more daily trading volume than Bitcoin.

Alongside USD volume sliding downward, web traffic has also declined for most major exchanges. Binance, for example, is seeing its traffic drop to a four-month low. Bitfinex gives a similar story.

Related: Looking to buy and sell Bitcoin? Check out our guide on the Best cryptocurrency exchanges for trading Bitcoins.

Overall, the metrics for the cryptocurrency market don’t seem too encouraging. However, one can just as well argue that retail interest always lags behind and is generally the last part of a general bull cycle. So, we can’t predict the future based on these depressed numbers. Yet, the steep decline in retail traders across the board is an indicator that we may not be ready to break any all-time highs anytime soon.

Do you believe these metrics indicate that the market still has not recovered from the 2018 bear market? Let us know your thoughts below in the comments.

Images are courtesy of Shutterstock, Twitter.

Top crypto projects in the US | April 2024

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Anton Lucian

Raised in the U.S, Lucian graduated with a BA in economic history. An accomplished freelance journalist, he specializes in writing about the cryptocurrency space and the digital '4th industrial revolution' we find ourselves in.

Raised in the U.S, Lucian graduated with a BA in economic history. An accomplished freelance journalist, he specializes in writing about the cryptocurrency space and the digital '4th industrial revolution' we find ourselves in.

READ FULL BIO

Sponsored

Sponsored