- Royal Bank of Canada (RBC) explores the idea of creating a cryptocurrency trading platform.

- BTC/USD is locked in a tight range on Tuesday.

Royal Bank of Canada (RBC) with nearly $500 billion assets under management is building a platform for trading bitcoins and other digital assets. The bank filed four patents on technical solutions for integrating cryptocurrencies in banking operations in Canada and the US.

The Logic reports that RBC will be able to open custodian accounts for cryptocurrencies. The bank refused to comment this information.

Notably, Bank of Canada is considering the issuance of public digital coin to combat the direct threat from private cryptocurrencies. Bank of China and a number of other global regulators have adopted similar approach.

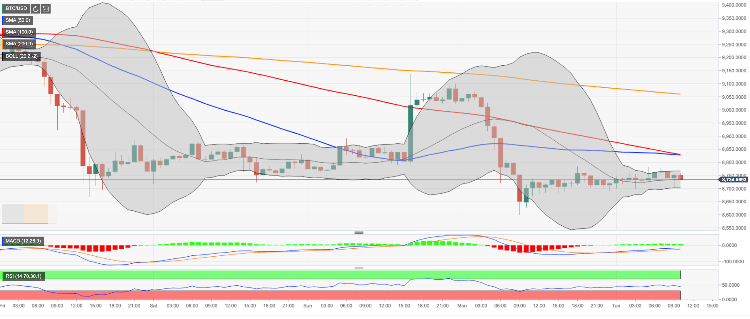

BTC/USD, the technical picture

At the time of writing, BTC/USD is changing hands at $8,734, having recovered from Monday's low pf $8,593. The first digital coin has been range-bound with bullish bias during early Asian hours, though the upside momentum seems to be fading away on approach to $8,770. This resistance is created by the lower line of 1-hour Bollinger Band. Once it is out of the way, the upside is likely to gain traction with the next focus on a confluence of SMA50 (Simple Moving Average) and SMA 100 1-hour at $8,830.

BTC/USD, 1-hour chart

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Uniswap nears $3 billion in daily trading volume despite Wells notice and fee hike

Uniswap's (UNI) price witnessed a double-fold crash in the past week after it received a Wells notice from the SEC and later due to the general crypto market crash over the weekend. In the past week, UNI has decreased more than 38%.

Arbitrum Price Prediction: 10% losses likely for holders ahead of $107 million worth of cliff token unlocks

Token unlocks are considered bearish catalysts, particularly when recipients are likely to cash in for a quick profit. The event, which adds tokens to the project’s circulating supply without increasing demand, leaves an effective imbalance in favor of supply.

Ethereum recovers from dip as Hong Kong ETH ETF approval sparks whale buying spree

Ethereum's (ETH) price slightly improved on Monday after Hong Kong approved applications for a spot Bitcoin and Ethereum ETF. Whales have also been accumulating ETH after the market dip over the weekend.

Bitcoin price delays pre-halving rally as US and China battle for BTC supremacy ahead of halving

Bitcoin has failed to showcase an enticing pre-halving rally. As the event remains less than a week out, traders and investors remain at the edge of their seats, with thoughts on whether the impact of the fourth cycle will be different than what has been seen before.

Bitcoin: BTC’s rangebound movement leaves traders confused

Bitcoin (BTC) price has been hovering around the $70,000 psychological level for a few weeks, resulting in a rangebound movement. This development could lead to a massive liquidation on either side before a directional move is established.