The Global Energy Storage Market May Reach 1 TWh By 2030

From: Bloomberg

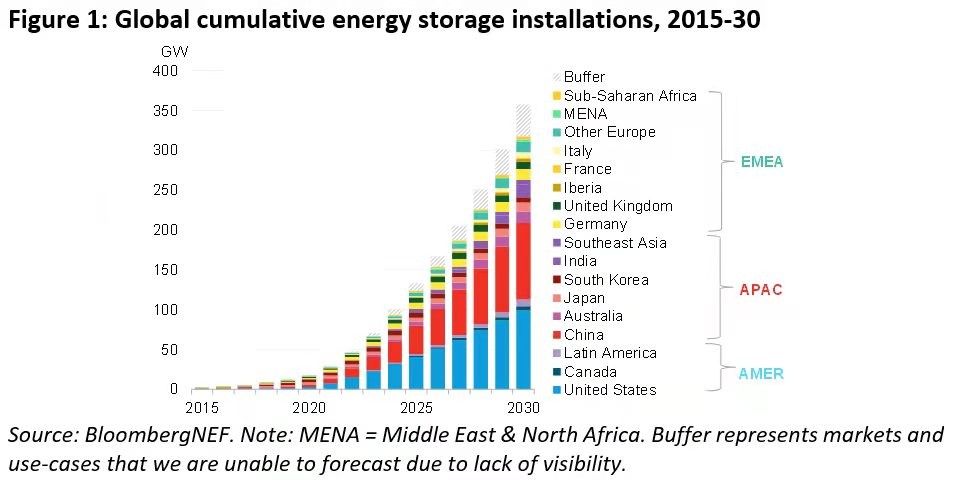

According to the latest prediction of the research company BloombergNEF (BNEF), by the end of 2030, the cumulative energy storage devices around the world will reach 358 gigawatts / 1028 gigawatt-hours, more than 20 times larger than the 170 gigawatts / 34 gigawatt-hours online energy storage devices at the end of 2020. BNEF estimates that this prosperity of stationary energy storage will require more than $262 billion in investment.

BloombergNEF's 2021 Global Energy Storage Outlook estimates that 345 gigawatts/999 gigawatt-hours of new energy storage capacity will increase globally between 2021 and 2030, which is more than Japan's overall power generation in 2020. The United States and China are the two largest markets, accounting for more than half of the global storage installations by 2030. The ambition of state governments and utility companies for clean energy has promoted the storage deployment of the United States. The ambitious installation goal of building 30 gigawatts by 2025 and stricter renewable energy integration rules have promoted the expected storage installation in China.

Other top markets include India, Australia, Germany, the UK, and Japan. Supportive policies, ambitious climate commitments, and the growing demand for flexible resources are common drivers.

Regionally, by 2030, The Asia Pacific region (APAC) will lead storage construction on a megawatt basis, but the Americas will build more on a megawatt-hour basis because storage plants in the United States usually have more storage hours. Europe, Middle East and Africa (EMEA) currently lags behind its peers due to the lack of targeted storage policies and incentives. This may be surprising given Europe's ambitious climate goals. Growth in the region is likely to accelerate as the penetration of renewable energy surges, more fossil fuel generators exit, and the battery supply chain becomes more localized.

Yiyi Zhou, clean power specialist at BNEF and lead author of the report, said: “The global storage market is growing at an unprecedented pace. Falling battery costs and surging renewables penetration make energy storage a compelling flexible resource in many power systems. Energy storage projects are growing in scale, increasing in dispatch duration, and are increasingly paired with renewables.”

BNEF's projections show that by 2030, the majority, or 55%, of energy storage buildings will be used to provide energy shifting (e.g. store solar or wind energy for later release). Renewable energy + storage projects in the same location, especially solar + storage projects, have become common all over the world.

Customer field batteries, including residential, commercial, and industrial batteries, will also grow at a steady rate. Germany and Japan are currently the leading markets, with considerable markets in Australia and California. BNEF predicts that by 2030, the energy storage facilities of households and enterprises will account for about a quarter of the global energy storage facilities. The desire of power consumers to use more self-produced solar energy and the demand for backup power supply are the main drivers.

By 2030, other applications, such as using energy storage to delay grid investment, may still be marginalized in most markets. If regulatory barriers are removed and incentives are arranged, network owners can consider storage as an alternative to traditional infrastructure investment.

Yayoi Sekine, head of decentralized energy at BNEF, added: “This is the energy storage decade. We’ve been anticipating significant scale-up for many years and the industry is now more than ready to deliver.”

The rapid development of battery technology is driving the energy storage market. The report found that the industry is using a variety of lithium-ion battery chemical components. In 2021, lithium-iron-phosphate (LFP) will be used more than nickel-manganese-cobalt (NMC) chemistries for stationary storage for the first time. LFP will become the main chemical choice for lithium-ion batteries in the energy storage industry at least until 2030, thanks to its dominant position in China and its increasing popularity in other parts of the world. BNEF has also updated its technology outlook to include sodium-ion batteries, competitors of lithium-ion batteries, which could play an important role by 2030.

Besides batteries, many non-battery technologies are being developed, such as compressed air and thermal energy storage. Compared with batteries, many of them can provide longer dispatch duration. However, BNEF expects that batteries will dominate the market at least until the 2030s, largely due to their price competitiveness, mature supply chain, and good performance record. If the new technology successfully surpasses lithium-ion batteries, the total absorption may be greater.