BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

Figure Technology Inc., a lending startup that wields the power of distributed ledger blockchain technology to transform the lending and borrowing process, announced Thursday it has closed a $103 million funding round led by Morgan Creek Digital.

The Series C funding round brings the total raised by Figure to more than $225 million and pushes the company’s valuation beyond $1.2 billion. Other investors joining included MUFG Innovation Partners Co. Ltd. DCM, Digital Currency Group, HCM Capital, Ribbit Capital, RPM Ventures, The Partners at DST Global and others.

“The team at Figure has accomplished so much in under two years, and this funding is a testament to that work,” said Mike Cagney, co-founder and chief executive of Figure. “This investment is going to give us the resources we need to further fuel our mission of leveraging blockchain to reinvent lending, borrowing and investing for consumers and the financial industry, both in the U.S. and abroad.”

This funding follows a $65 million Series B round that closed in February.

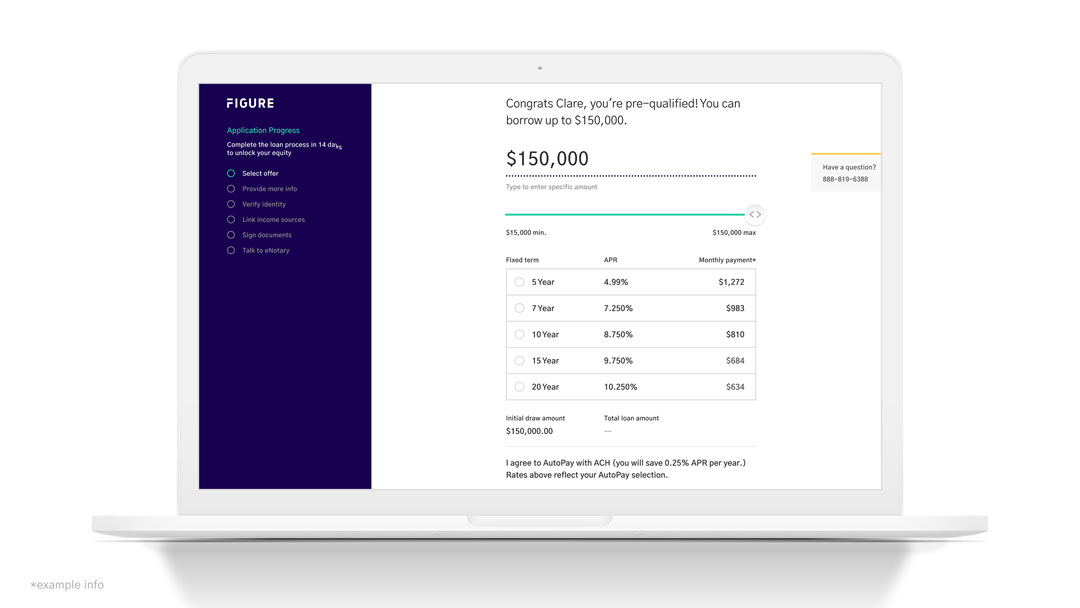

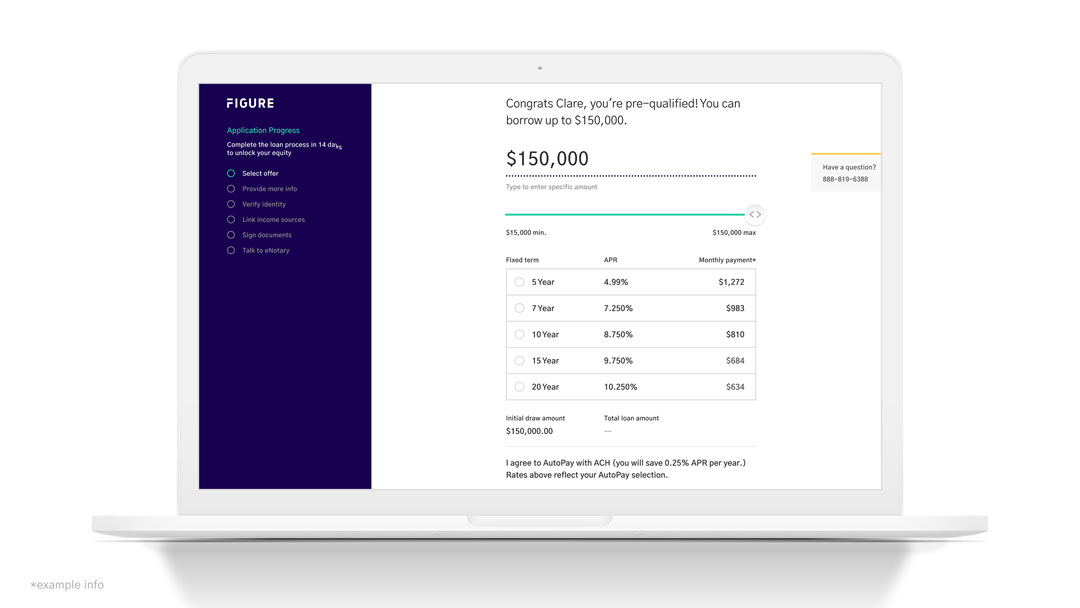

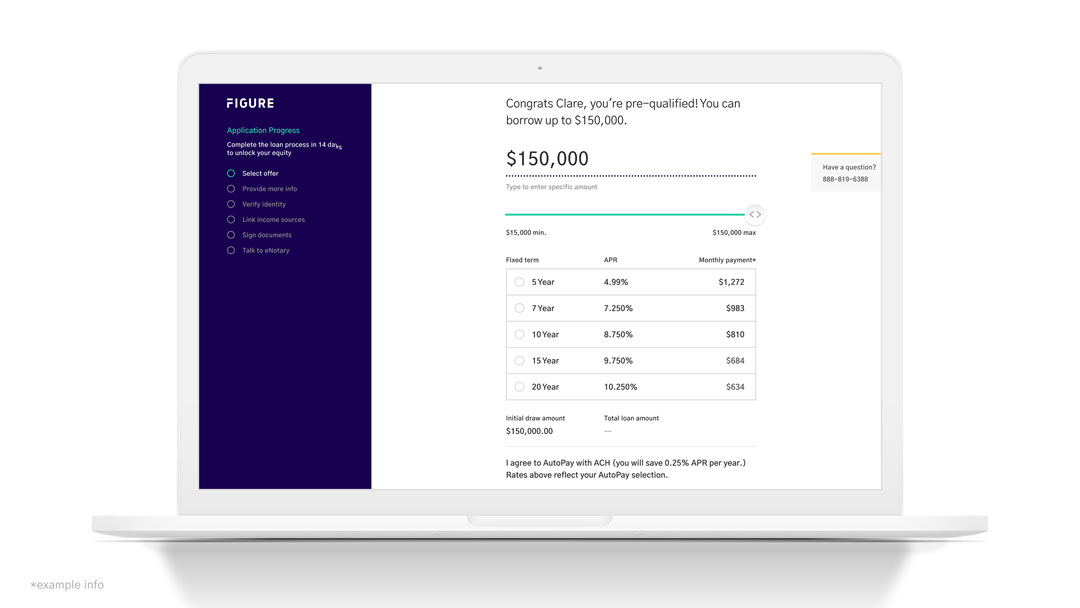

The company’s flagship product is Figure Home Equity Line, a fixed-rate line of credit that provides approval in under five minutes and funding in a little as five days. All of this is executed online.

The vision of the company is to allow customers to borrow against the equity in their home without having to go through the current paperwork intensive process that traditional lenders require. Such processes can take up to 45 days — time that could be better spent enjoying the outcome of a successful loan by making use of the money.

Figure now also offers student loan and mortgage refinance products. Since its launch in 2018, Figure has originated over $700 million in loans, all registered and secured on blockchain technology.

The company uses what it calls a distributed stakeholder blockchain known as Provenance, unveiled in 2018. Provenance spun out of Figure at launch and operates as a decentralized blockchain today. It uses cryptography and distributed ledger technology to originate, finance and sell loans. Blockchain technology enables a loan to be registered and audited, all while enabling privacy and security.

Cagney left as CEO of Social Finance Inc., known as SoFi, following press reports of sexual harassment problems at the company, including Cagney’s reported relationships with several female employees. Investors in Figure told Axios they believe Cagney has “learned from his mistakes and his new company is ‘doing things better.'”

“One of our core investment theses is that every stock, bond, currency and commodity will eventually be digitized,” said Anthony Pompliano, co-founder and partner at Morgan Creek Digital. Figure is leading that transition from the front and is bringing radical change to finance and lending markets. Leveraging blockchain technology to drive speed, efficiency and cost savings to lending, Figure is focused on driving out waste and dead time inherent to the lending process.”

Figure also plans to add loan securitization to its product capabilities in the future, which would enable originators and lenders to turn loans into marketable securities, creating a market for raising cash and opportunities for investors.

THANK YOU