- The cryptocurrency market consolidates after a sharp sell-off during the week.

- Bitcoin’s technical picture looks bearish at this stage.

Bitcoin (BTC) lived through another tough week, The first digital coin dropped below the critical support of $7,800 and tested the lowest level in recent five-month at $7,300. While the coin managed to recover to $7,650 by the time of writing, the upside momentum remains weak and unimpressive. Bitcoin is still down nearly 6% on a week-to-week basis. The coin has been sliding down for the third month is a row. In October, the first cryptocurrency has lost nearly $1,000.

Whales rule the world

The cryptocurrency market has been at the mercy of crypto whales activity. Just as the real marine mammals, they leave an impact when they move around, or event supposed to move.

This week in the cryptocurrency markets was marked by a sudden sell-off, allegedly caused by massive long liquidations on BitMEX that cascaded into a series of triggered stops and took Bitcoin to the lowest level since May 2019. The price collapse caught the vast majority of c crypto traders off guard, even though market experts and analysts had long warned about the possible sell-off. The movement was too fast as Bitcoin lost over 6% of its value in a matter of minutes.

Sure enough, the true reasons of the sell-off remain unknown, but whales positioning is always worrisome for cryptocurrency traders as it leads to wild market gyrations.

Meanwhile, trading volumes on Bakkt are growing fast. After a slow start, the platform for deliverable Bitcoin futures seems to have woken up. According to the data, provided by Bakkt Volume Bot, the number of traded contracts reached 640 and hit the all-time high on October 23. This is over 652% higher than the previous day. Notably, the growth of trading volumes on Bakkt coincided with the massive sell-off on the cryptocurrency market. While it is hard to say for sure if these two developments are interconnected, but the trading volumes on Bakkt have retreated to 326 contracts on October 24. Bitcoin price stopped at $7,450 with no signals of a strong recovery in sight.

Read more about Bakkt trading volumes here

Notably, Bakkt has recently announced the launch of Bitcoin options. The new crypto-based derivatives are expected to go online in December 2019. The company hopes that the new product will attract more institutional investors and foster platform development.

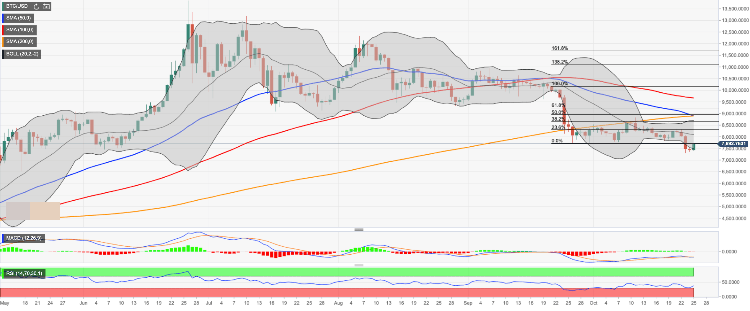

BTC/USD, daily chart

BTC/USD broke free from the range that had been dominant for the past three weeks. However, Bitcoin bulls are not happy with the direction of the breakthrough as the cracked SMA100 (Simple Moving Average) weekly for the first time since the beginning of May. This development has worsened the bitcoin's technical picture, while a failure to attract enough buyers to engineer recovery signals that more sell-off may be in store.

The nearest support area of $7,300-$7,300 is created by the lower line of the weekly Bollinger Band and the recent low touched on October 23. Once it is broken, the sell-off is likely to gain traction with the next focus on psychological $7,000 strengthened by the lower line of four-hour Bollinger Band. A sustainable move below this handle will open up the way towards SMA50 weekly at $6,800.

On the upside, the first critical resistance area awaits bitcoin bulls on approach to $7,800. This is a former support level that flipped into a resistance, which makes it particularly strong. Once it is cleared, a psychological $8,000 will come into view. There is a middle line of the Bollinger Band on a daily chart marginally above this handle. It makes the resistance stronger and increases the chances fo retreat back inside the current range.

An ultimate resistance is created by a combination of SMA50 and SMA200 daily on approach to $8,900. This barrier separates us from a psychological $9,000.

Notably, the Relative Strength Index (RSI) stays flat close to the oversold area, though it is still pointing downwards on a weekly timeframe. It means that the coins is vulnerable to further losses in the long run. SMA50 and SMA200 on a daily chart are creating a dead cross, which is also a strong bearish signal.

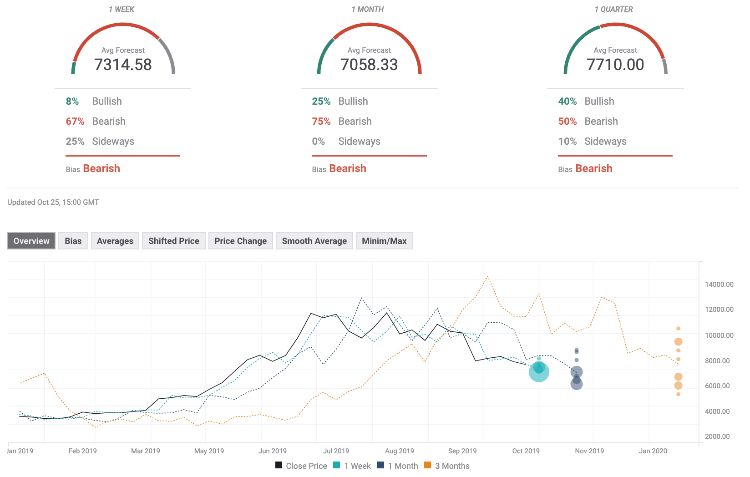

The Forecast Poll of experts worsened significantly since the previous week. Expectations of all timeframes are mostly bearish. The average price forecasts are well below 8,000.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

PancakeSwap loses nearly 3% value intraday as the DEX crosses $1 billion in trade volume

Decentralized exchange (DEX) PancakeSwap (CAKE) announced in an official tweet that it has crossed $1 billion in trade volume on the Layer 2 chain, Base. CAKE on-chain metrics support the thesis of a recovery in the DEX token’s price.

Shiba Inu hits new milestone, over $9 billion worth of SHIB tokens burnt

Shiba Inu (SHIB), the second-largest meme coin in the crypto ecosystem, recently hit a milestone in the volume of tokens burned. Shiba Inu has burnt over 410.72 trillion SHIB tokens since the inception of the burn mechanism in the project, worth over $9 billion.

Dogwifhat crashes 60%, but here's why you should not buy WIF yet Premium

Dogwifhat (WIF) price shows a slowdown in the bearish momentum as it sets up a potential range. This development could lead to a good buying opportunity from a long-term perspective.

XRP struggles to overcome $0.50 resistance, SEC vs. Ripple could enter final pretrial conference

XRP is struggling with resistance at $0.50 as Ripple and the US Securities and Exchange Commission (SEC) are gearing up for the final pretrial conference on Tuesday at a New York court.

Bitcoin: BTC’s rangebound movement leaves traders confused

Bitcoin (BTC) price has been hovering around the $70,000 psychological level for a few weeks, resulting in a rangebound movement. This development could lead to a massive liquidation on either side before a directional move is established.