Factors to Impact Public Storage (PSA) This Earnings Season

Public Storage PSA is slated to release second-quarter 2022 results on Aug 4 after market close. Both its quarterly revenues and funds from operations (FFO) per share are likely to have seen year-over-year increases.

In the last reported quarter, this self-storage real estate investment trust (“REIT”) delivered a surprise of 1.67% in terms of FFO per share. Results reflected an improvement in the realized annual rent per available square foot in the reported quarter. The company also benefited from its expansion efforts through acquisitions, developments and extensions.

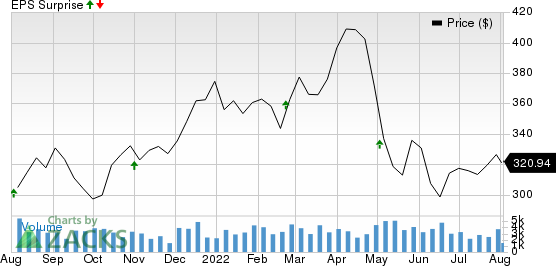

Over the last four quarters, Public Storage surpassed the Zacks Consensus Estimate on all occasions, the average beat being 4.49%. The graph below depicts the surprise history of the company:

Public Storage Price and EPS Surprise

Public Storage price-eps-surprise | Public Storage Quote

Let’s see how things have shaped up before this announcement.

Key Factors

Public Storage is likely to have gained from its solid presence in key cities and high brand value in the second quarter. PSA is also likely to have benefited from its technological advantage amid favorable market fundamentals and maintained a healthy balance sheet position.

In addition, the company has been capitalizing on growth opportunities. In the March-end quarter, Public Storage acquired 10 self-storage facilities comprising 0.8 million net rentable square feet of area for $127.7 million. Following Mar 31, 2022, the company acquired or was under contract to acquire 11 self-storage facilities spanning 0.9 million net rentable square feet of space across nine states for $147.2 million. Such acquisition and expansion initiatives are also anticipated to have stoked the company’s growth during the period under consideration.

Amid these, this REIT is likely to have seen growth in revenues in the quarter to be reported with healthy rental rates. However, with the impact of the pandemic abating, vacancy is likely to increase.

Public Storage has one of the strongest balance sheets in the sector with adequate liquidity to withstand any challenges and bank on expansion opportunities through acquisitions and developments. This is likely to have continued in the second quarter as well.

The Zacks Consensus Estimate for second-quarter revenues from self-storage facilities stands at $950 million, suggesting an increase from the $917.02 million witnessed in the prior quarter and $776.99 million in the year-ago period. Quarterly revenues from ancillary operations are presently projected at $56.76 million, slightly up from the prior-quarter figure of $56.43 million and ahead of the $52.32 million registered in the comparable period last year.

The Zacks Consensus Estimate for quarterly revenues stands at $1.02 billion, calling for a 23.4% year-over-year increase.

However, PSA operates in a highly fragmented market in the United States, with intense competition from numerous private, regional and local operators. Furthermore, there is a development boom of self-storage units in several markets. This high supply is likely to have fueled competition.

PSA’s activities during the quarter under review were not adequate to gain analysts’ confidence. The Zacks Consensus Estimate for second-quarter FFO per share has been revised a cent downward to $3.92 in the past week. However, it calls for 24.4% year-over-year growth.

Here Is What Our Quantitative Model Predicts:

Our proven model does not conclusively predict a surprise in terms of FFO per share for Public Storage this season. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an FFO beat. However, that is not the case here.

Public Storage currently carries a Zacks Rank #3 and has an Earnings ESP of -0.54%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Performance of Other REITs

Extra Space Storage Inc. EXR reported second-quarter 2022 core FFO per share of $2.13, beating the Zacks Consensus Estimate of $2.04. The figure also came in 29.9% higher than the prior-year quarter’s $1.64. Extra Space Storage’s results reflected better-than-anticipated top-line growth. The same-store net operating income improved year over year.

American Tower Corporation AMT reported second-quarter 2022 consolidated adjusted FFO per share of $2.59, which surpassed the Zacks Consensus Estimate of $2.35. The bottom line improved 7% year over year. Results reflected improving revenues across its Property segment. American Tower also recorded decent year-over-year organic tenant billings growth of 2.6% and total tenant billings growth of 7.8%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Note: Anything related to earnings presented in this write-up represent funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American Tower Corporation (AMT) : Free Stock Analysis Report

Public Storage (PSA) : Free Stock Analysis Report

Extra Space Storage Inc (EXR) : Free Stock Analysis Report

To read this article on Zacks.com click here.